The Ultimate Overview to Odoo, ZATCA, FATOORAH, and Tax Obligation Com…

페이지 정보

Writer Miquel Date Created25-07-24 22:07관련링크

본문

| Country | Belgium | Company | Easycounter zatca e-invoices odoo & Sallee GmbH |

| Name | Miquel | Phone | Miquel Miquel mbH |

| Cellphone | 480160764 | miquelsallee@hotmail.co.uk | |

| Address | Rue Du Monument 382 | ||

| Subject | The Ultimate Overview to Odoo, ZATCA, FATOORAH, and Tax Obligation Com… | ||

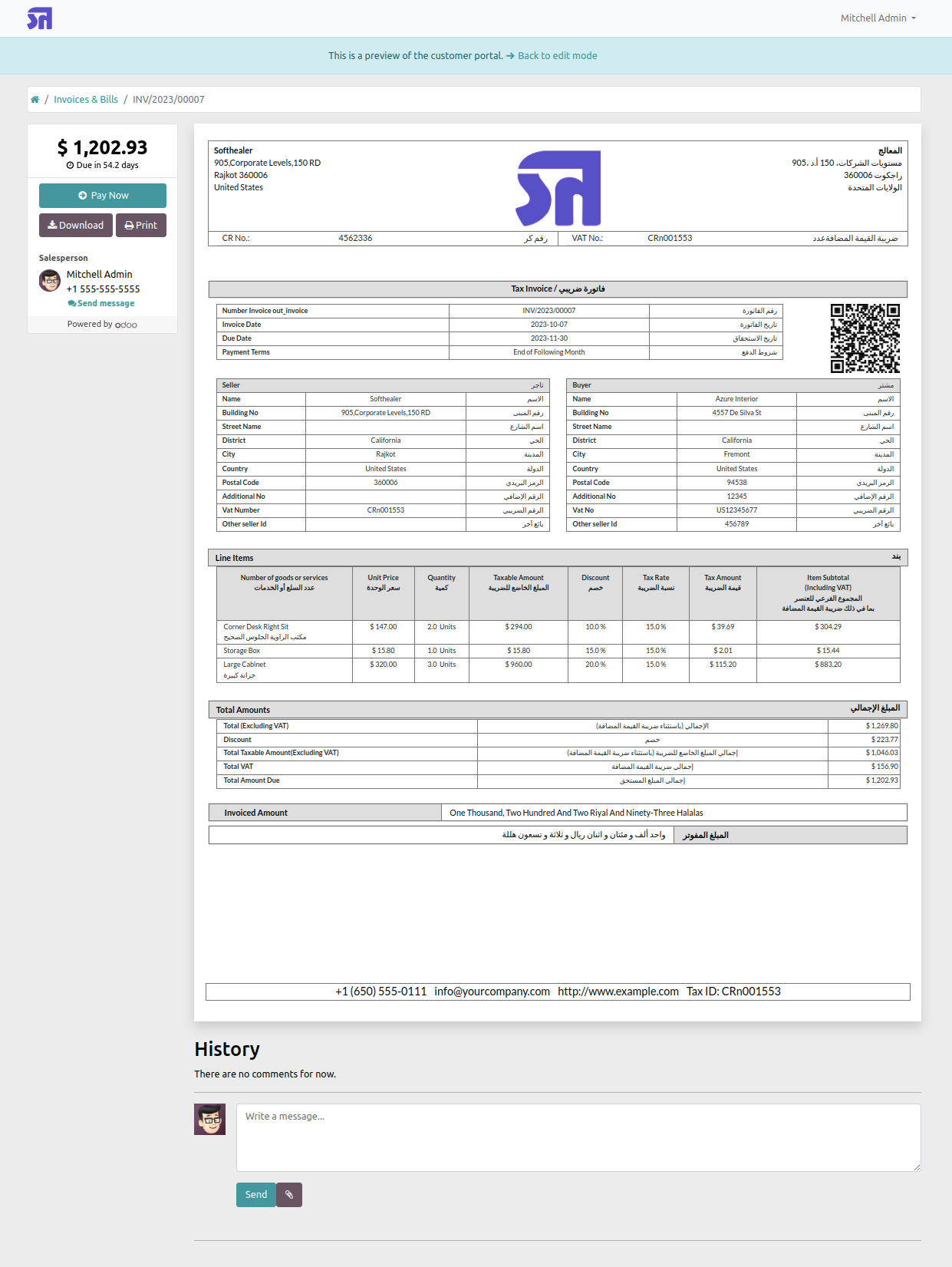

| Content | Saudi Arabia is entering a brand-new period of tax obligation transparency and electronic change. With the intro of FATOORAH, an across the country e-invoicing system, and strict enforcement by the Zakat, Tax Obligation and Customs Authority (ZATCA), services should now adjust to an advanced, data-driven compliance environment. Whether you're a neighborhood SME, an international, or a fast-scaling startup, your ERP system plays an essential role. And in this landscape, Odoo is emerging as the go-to system for easy tax automation, conformity, and development. ZATCA and FATOORAH: Setting the New RequirementZATCA is the central authority in charge of looking after tax (BARREL, Zakat, Corporate Tax obligation), personalizeds, and currently e-invoicing under the FATOORAH initiative. Its mission? Promote liability, openness, and modernization in the Kingdom's service setting. FATOORAH is ZATCA's flagship initiative to digitize exactly how organizations concern and share tax invoices. The system is being rolled out in two major stages: Generation Phase (since Dec 2021): Needs all billings to be released electronically in a standard XML or PDF/A -3 style with QR codes. Integration Stage (ongoing considering that 2023): Requireds real-time assimilation with ZATCA's API for invoice clearance, cryptographic stamping, UUID, and hash chains. This change affects every VAT-registered company in the Kingdom. Odoo: More Than Just an ERPOdoo is an open-source, modular ERP that is increasingly favored by Saudi organizations for its scalability and simplicity of localization. It's not just about compliance-- it's about transforming monetary operations. With Odoo, you can:Generate compliant e-invoices with QR codes, UUIDs, and digital trademarksIncorporate directly with ZATCA's FATOORAH API for invoice clearanceAutomate Zakat and VAT calculations and filingsEnsure audit-readiness with appropriate logs and coverageTrack withholding taxes and create certified reports for international settlementsNavigating the Saudi Tax Obligation Landscape in 2025Services in Saudi Arabia deal with an one-of-a-kind mix of tax obligations:BARREL (15%) on many goods and servicesZakat, a spiritual riches tax obligation for GCC-owned entitiesCorporate Tax Obligation (20%) for non-Saudi shareholdersKeeping Tax, related to payments to foreign entitiesThese taxes currently need to be recorded and reported digitally, with deducible and proven documents through systems like odoo saudi tax localization; server.easycounter.com,. Why Conformity with ZATCA is a Competitive AdvantageTax obligation conformity is no more just a cost of working-- it's a growth approach. Right here's just how: Faster funding & tenders: Financial institutions and federal government companies favor ZATCA-compliant companies. Reduced audit threats: Digitized documents simplify confirmations. Functional performance: Automation minimizes the tons on financing groups. More powerful online reputation: Transparent services make even more customer trust fund. Real-World Benefits of Odoo + FATOORAH IntegrationReduced Errors: Automated computations and billing recognitions. Real-Time Compliance: Instantaneous API consult ZATCA. Expense Savings: Stay clear of charges and streamline your accounting process. Scalability: Easily expand to brand-new branches or countries with regular tax obligation guidelines. Last Thoughts: Future-Proof Your Saudi ServiceThe digital economic climate isn't coming-- it's currently here. And with FATOORAH, ZATCA, and tax innovation improving Saudi Arabia's organization landscape, business must act decisively. Odoo provides the devices, adaptability, and localization you need to prosper-- not simply endure-- in this new regulatory environment.  |

||

CS Center

CS Center